What Rate-Cuts Can And Cannot Do

Share

What Rate-Cuts Can And Cannot Do

Authored by Jeffrey Tucker via The Epoch Times,

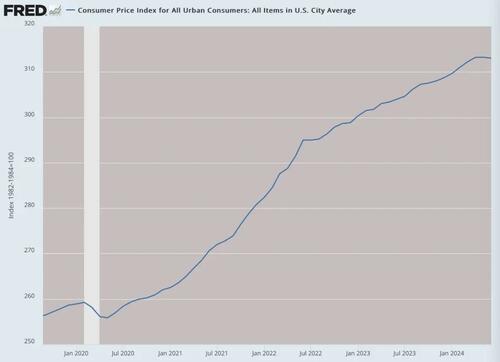

June’s year-over-year Consumer Price Index is still running 3 percent, which is now considered more-or-less on target. Five years ago, that would have been seen as intolerably high. The month-over-month decline of 0.1 percent, the best in a year, was driven by gas and used cars, which are reported as down 10 percent year over year (but still up 30 percent over four years).

So while the financial press trumpeted the great news for consumers, there needs to be some context here. This is a minor blip, heavily influenced by what it excludes not to mention adjustments we cannot see, and easily reversed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Some people speculate that 3 percent is the new target and that the old 2 percent standard is being deprecated. That very well might be true. That’s very bad news for consumers and small businesses, however. It means that incomes will continue to have a hard time keeping up with purchasing power.

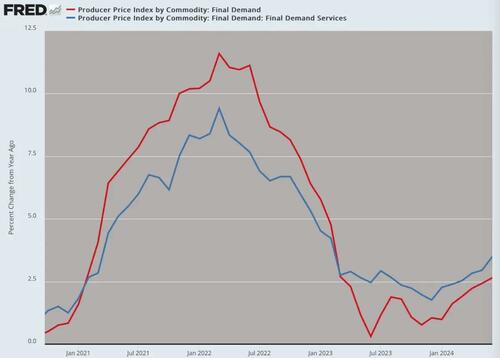

This perception is reinforced by the Producer Price Index (PPI), which garners far less attention, but which clearly shows signs of re-acceleration. The year-over-year changes are worse than in a full year.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Once you adjust income per hour by even the official data, incomes have been severely harmed in recent years.

This report prepares the Federal Reserve for what has