Investor Greed Returns With A Vengeance

Share

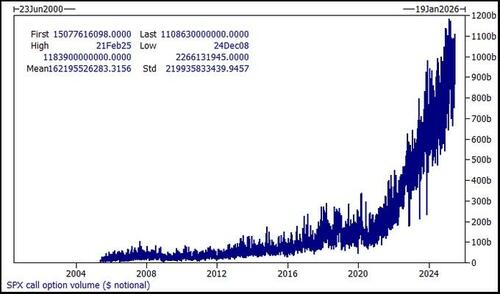

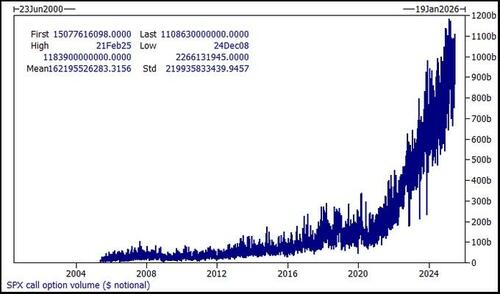

Retail investor greed again dominates market activity, echoing some of the same speculative behaviors seen during previous risk-on phases. Retail investors show heightened risk appetite across multiple metrics, from options trading to leveraged ETF flows, with little regard for valuation or macroeconomic headwinds.

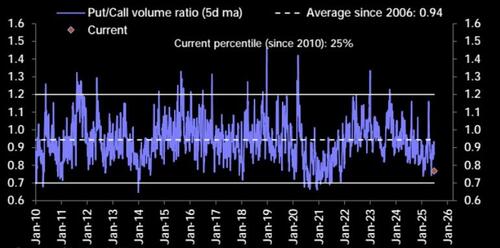

Put/call ratios are flashing strong bullish sentiment, with the SPY ratio hovering around 0.79, reflecting an imbalance toward calls over puts.

Investor greed primarily drives this skew, particularly in names and sectors associated with high momentum or popular narratives.

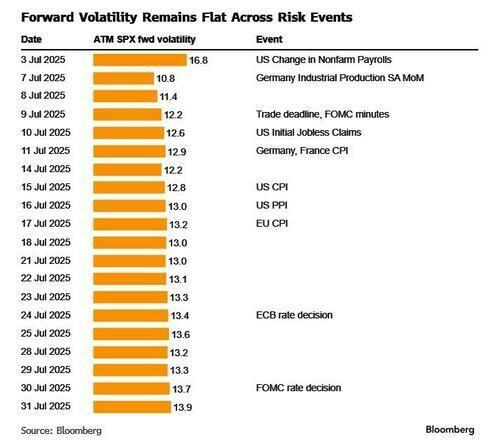

“Despite the looming July 9th trade negotiation deadline, not much is priced into the SPX vol surface for the event, suggesting investors either expect a positive resolution or for the deadline to be extended. Interestingly, the flattening in skew was mostly concentrated in the front-month, suggesting this was mostly positioning-driven FOMO-type call buying. Longer-dated skew remains steep in comparison.” – CBOE

The surge in call option volumes has occurred across semiconductor plays, especially in leveraged vehicles like SOXL, the 3x bullish semiconductor ETF, where open interest in call options far exceeds puts. Similar patterns are emerging in thematic ETFs like RETL (3x retail) and DRN (3x real estate), which are seeing elevated daily volume despite mixed performance. This appetite for leverage is being pushed further with the proliferation of single-stock leveraged ETFs, such as HIMZ, a leveraged play on HIMS, which saw a dramatic 70% collapse after a corporate announcement, highlighting how retail speculation often ignores risk asymmetry.

<a data-image-external-href=”” data-image-href=”/s3/files/inline-images/image-15-1024×282.jpg?itok=4d9NXgK7″