Does Inflation Mean We Can Look For “Big Shorts”

Share

During the just ended school holidays (halleluiah!) I had my family around to stay. Strangely, my father had never seen “The Big Short”, so after dinner we settled down to watch it. The underlying message of the little guy sticking it to the big guy is of course very satisfying, but even at the end of the Big Short, all the main characters accept the fact that bailouts were coming, and closed their positions.

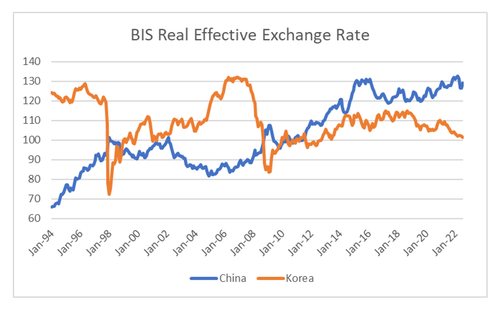

And ever since, buy the dip has been the correct strategy. I made decent money in shorting material stocks from 2011 through to 2016, but the big play underlying that was a potential Chinese Yuan devaluation, which has never materialised. I had assume China would be like South Korea, and see big devaluations when growth slowed. Instead the Chinese Yuan has stayed strong and stable.

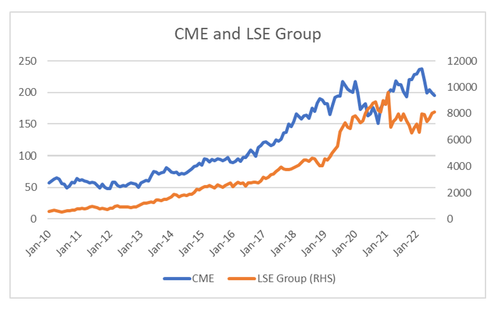

Another area I did a lot of work on was clearinghouses. If clearinghouses had followed their own rules, then bankruptcy, or at least large equity raise from large banks were on the cards. In the end, clearinghouses just ignored their own rules to give de facto bailouts. I have many posts on it, so have a look yourself, but shareholders and clearinghouses have continued to prosper.

The US Federal Reserve really sets the tone for global monetary policy. And since 2018, one key commodity has been sending very deflationary signals in the US

Continue reading Does Inflation Mean We Can Look For "Big Shorts" at ZeroHedge.