Druckenmiller’s Only ‘High Conviction Trade’: Short The “Weaponized” Dollar

Share

Druckenmiller’s Only ‘High Conviction Trade’: Short The “Weaponized” Dollar

He is not the first, and he won’t be the last, but “everyone’s new favorite theme… US dollar debasement” appears to have taken hold in the mind of billionaire hedge fund manager Stanley Druckenmiller as The FT reports that he is betting against the US Dollar as his only high conviction trade.

Amid what he calls, the most uncertain environment for markets and the global economy in his 45-year career, Druck reflected on his disappointment in himself for missing the 2022 USD rally, “because I could not bring myself to buy Joe Biden and Jay Powell… It was probably the biggest miss of my career”.

But, having helped George Soros break the Bank of England in 1992, the billionaire said at an event hosted by the Norwegian sovereign wealth fund in Oslo on Tuesday that “one area I’m comfortable is I’m short the US dollar,” adding:

“Currency trends tend to run for two or three years. We have had a long [run] higher.”

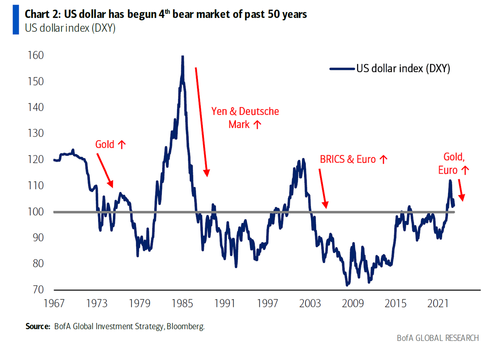

This fits with Michael Hartnett’s recent call that the USDollar is about to enter its “4th bear market of the past 50 years.“

Specifically, the 69-year-old’s thesis is that US policymakers will fold like a broken lawnchair at the first signs of economic downturn, unleashing a wave of rate-cuts, igniting momentum to the downside for the world’s reserv currency:

“The Fed has shown some mettle over the last year but historically I would not say [Federal Reserve chair] Jay Powell is a profile in courage,” he said.

However, his view had a clear geopolitical

Continue reading Druckenmiller's Only 'High Conviction Trade': Short The "Weaponized" Dollar at ZeroHedge.