Report: Government Covid Handouts Screwed Over Low-Income Households By Spiking Inflation

Share

For all the trillions of dollars spent during Covid lockdowns, what did taxpayers receive, other than massive amounts of fraud? A new analysis provides additional insight into how much of the spending was not only ineffective but unnecessary.

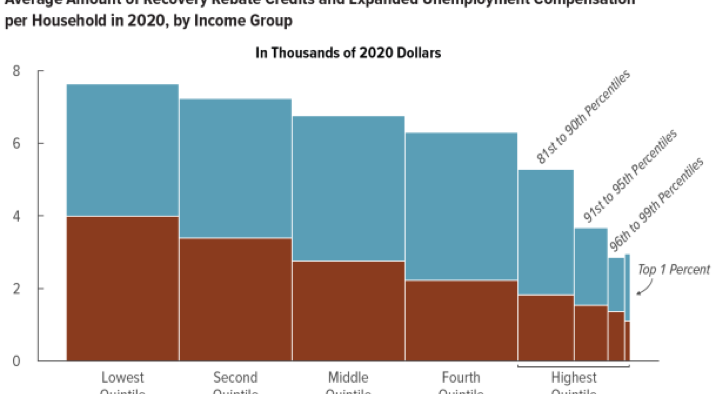

A recently released Congressional Budget Office (CBO) report demonstrates the wastefulness of the spending spree. On net, government transfers increased incomes along all levels of the spectrum, rich and poor. These giveaways not only gave money to people on the income spectrum who didn’t need it, but worsened our debt and deficits and unleashed the monster of inflation on the American people.

Poor Households Hardest Hit

The CBO report tracks changes in incomes from 2019 to 2020. In so doing, it examines the effects of the spending included in the multitrillion-dollar CARES Act and other legislation enacted by President Trump, a Democrat-controlled House of Representatives, and a Republican Senate. Because the analysis does not include 2021, it excludes the effects of the additional spending enacted by President Biden and Democrats in Congress in the spring of that year.

The report shows how low-income households bore the brunt of the economic effects of Covid lockdowns. In 2020, the income before taxes and government transfer payments in the lowest quintile (i.e., the lowest 20 percent of households on the income spectrum) declined from $24,200 to $21,900 — a drop of almost 10 percent.

By contrast, income before taxes and transfers for the three highest income quintiles actually rose. For the wealthiest quintile (i.e., the top 20 percent of household income), average income before taxes and transfers rose by more than 6 percent, from $337,400 to $357,800. And CBO notes that the income for the richest 1 percent grew by a far greater amount. In most cases, the income growth for wealthy households