TRILLIONS AND TRILLIONS AND TRILLIONS

Share

The Congressional Budget Office (CBO) just published their “current policy” score of the Senate reconciliation bill, showing the bill would add about $500 billion less to the deficit than extending all the expiring 2017 tax cuts. Against a more appropriate current law baseline, and including interest, these numbers suggest the bill would add over $3.9 trillion to the national debt. Specifically, the bill includes roughly $4.45 trillion of net tax cuts and nearly $300 billion of gross spending increase, partially offset by nearly $1.5 trillion of gross spending cuts. We estimate the bill would increase interest costs by nearly $700 billion.

CBO Score of Senate One Big Beautiful Bill Act

| Title | Deficit Increase (-) / Decrease (FY 2025-2034) |

|---|---|

| Agriculture | $120 billion |

| Armed Services | -$150 billion |

| Banking | $2 billion |

| Commerce, Science, & Transportation | $44 billion |

| Energy & Natural Resources | $27 billion |

| Environment & Public Works | $3 billion |

| Finance | -$3,466 billion |

| HELP | $307 billion |

| Homeland Security | -$129 billion |

| Judiciary | -$9 billion |

| Interactions | -$3 billion |

| Subtotal, Primary Deficit Impact | -$3,253 billion |

| Interest | -$690 billion |

| Total Debt Impact | $3.94 trillion |

Source: CBO, CRFB estimates based on current policy adjustment. Figures may not sum due to rounding.

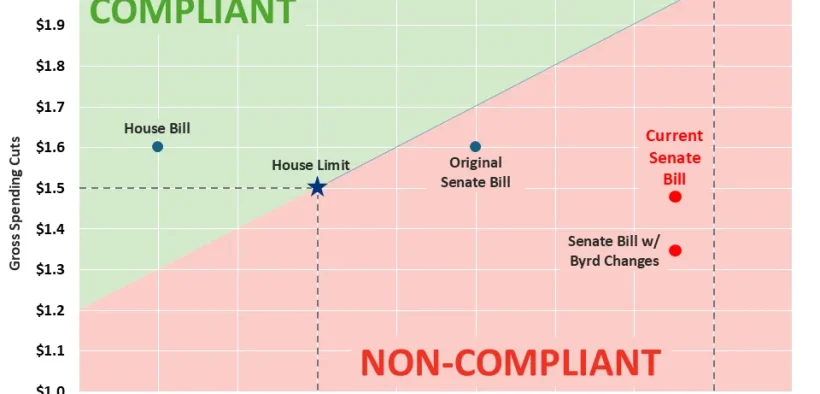

The Senate bill would borrow almost $1 trillion more than the House bill. It would also fail to comply with the House reconciliation instructions requiring $2 trillion of gross spending cuts or offsetting tax cuts changes, falling nearly $500 billion short.

Even these numbers understate the potential costs of the bill, since the legislation relies on a number of arbitrary expirations. Borrowing could rise by another $1 trillion – to $5 trillion or more – if temporary provisions were made permanent.

The Senate should reject this bill and work toward a fiscally responsible alternative that reduces rather than explodes our high and rising debt.