US Manufacturing Survey Hits 16-Month-Lows But Prices Paid Spiked In October

Share

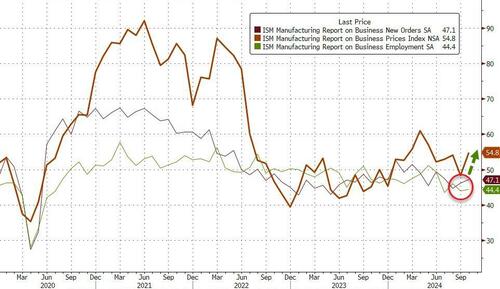

Minutes after the BLS reported the biggest drop in manufacturing jobs since the COVID lockdowns, S&P Global reported its US Manufacturing PMI rose to 48.5 in October (still in contraction) from 47.3 in September (as ‘hard data’ has exploded higher this month. ISM’s Manufacturing PMI was worse than expected, dropping from 47.2 to 46.5 in October – the lowest since June 2023…

That is the fourth straight month of contraction (sub-50) for the Manufacturing PMI

Source: Bloomberg

The ISM Manufacturing Prices Index spiked back higher in October as both new orders and employment remain in contraction sub-50)…

Source: Bloomberg

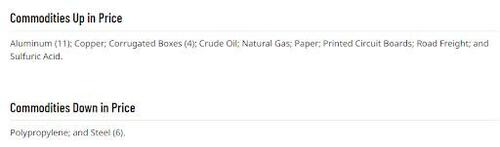

Commodity prices are UP!

Stagflation, much?

The responses from ISM survey participants was a shitshow:

“Right-sizing continues. Contingency plans have been formulated to anticipate trade policies that will impose tariffs on key materials.” [Chemical Products]

“Market demand has significantly decreased in the second half of 2024 and is expected to be soft through the first quarter of 2025. Although inflation has stabilized and returned to historical levels, and interest rates are decreasing, there appears to be a general pessimism in the economy that is driving customers to be more restrictive in their capital expenditures, including investment in commercial vehicles. Uncertainty in the outcome of the upcoming election has resulted in several risk analysis studies to be prepared, particularly focused on the future of the electric vehicle (EV) migration and trade restrictions/penalties.” [Transportation Equipment]

“Sales have been very slow the past