Retail Speculation Is Back With A Vengeance

Share

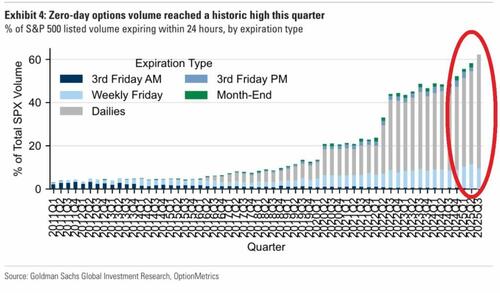

Retail speculation is once again gripping the markets. A recent Wall Street Journal article highlighted how the latest retail gambling vehicle—zero-days-to-expiration (0DTE) options—has exploded in popularity. According to CBOE, trading volumes in these contracts have surged nearly sixfold over the past five years, with retail traders now accounting for more than half of all transactions. This rapid rise in speculative options trading has intensified since 2020.

This is more than a quirky market statistic. It’s a glaring warning sign of rising risk-taking behavior among retail investors. History consistently shows that markets peak when the average investor starts chasing lottery-like returns. Options, by design, are speculative instruments used to hedge risk or make directional bets. However, the explosion in 0DTE options points to a significant behavioral shift from investing to outright gambling.

One of the most visible examples of this shift is Robinhood. The brokerage earns four times more revenue from options trading than traditional stock commissions, while its stock price has soared over 300% in the past year. The speculative fervor isn’t limited to options; we continue to see it in meme stocks, cryptocurrencies, and high-flying tech names. The appeal is easy to understand—0DTE options offer the illusion of life-changing returns for a small upfront cost. Unfortunately, the reality is far harsher. Most retail traders lose money, often spectacularly. While market makers like Citadel Securities collect billions in profits, the average investor learns, too late, that leverage cuts both ways.

Retail Speculation & the Perils of Leverage

This cycle of retail speculation is nothing new. In early 2021, just months