Buffett Calls The Top: Berkshire Dumps 100 Million Apple Shares As Unprecedented Selling Spree Boosts Cash To Record Quarter Trillion Dollars

Share

Back in August, when discussing Buffett’s ongoing liquidation of his Bank of America stake, we said that “Berkshire’s rising cash stockpiles merely reflect the firm’s inability to find deals in today’s overvalued and weak economic environment”, little did we know just how accurate that would be, because just one day later we and the rest of the market were stunned to learn that far from only dumping Bank of America, the 94-year-old Omaha billionaire had been busy quietly liquidating his most iconic holding in an unprecedented selling spree that sent Berkshire’s cash pile soaring by a record $88 billion to an all time high $277 billion at the end of Q2.

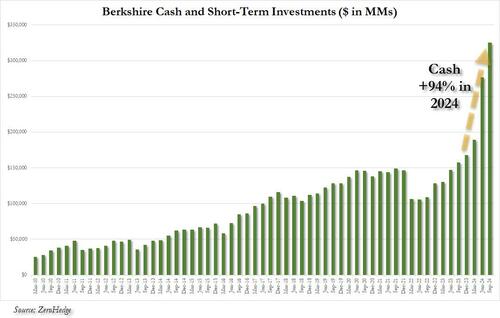

That was just the beginning, however, and this morning we subsequently learned that through the end of Q3, Berkshire’s unprecedented cash build continued, and the world’s largest conglomerate added another $48 billion to its cash – through both “harvesting” (i.e., selling of existing holdings) and cash from operations, taking it to a record $325.2 billion, or nearly a quarter trillion in cash. As shown for context in the chart below, Berkshire has nearly doubled its cash holdings from $168 billion at the start of the year to a staggering $325 billion 9 months later, up 94%!

The bulk of the new cash came from sales: in the third quarter, Berkshire sold a net $34.6 billion worth of stock, following the record $75.5 billion in Q2 liquidations, the bulk of which we now know came from Buffett’s sale of half his Apple shares. In other words, the third quarter was the 8th consecutive quarter