CCP Mouthpiece Threatens Elon Musk Over COVID Lab-Leak Comments Authored by Gary Bai via The Epoch Times, Elon Musk, CEO of Twitter and Tesla, stood in the crosshairs of the Chinese Communist Party (CCP) when ...

Thomas Jefferson’s Blueprint For Handling The National Debt Authored by Michael Maharrey via SchiffGold.com, The way Thomas Jefferson handled the national debt should serve as a blueprint for today. But instead, modern presidents look more ...

If confirmed as IRS commissioner, Daniel Werfel says he will commit to not increasing tax audits on businesses and households making less than $400,000 per year. Anticipating questions ahead of his confirmation hearing Wednesday before ...

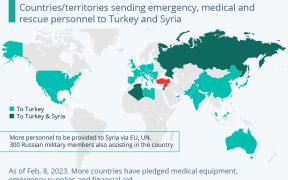

Who Is Sending Rescue Teams To Turkey And Syria? Janez Lenarcic, the European Commissioner for Crisis Management, announced on Twitter yesterday that almost 1,200 emergency personnel were being dispatched to Turkey in a coordinated effort by the European Union ...

Distract, Divide, & Conquer: The Painful Truth About The State Of Our Union Authored by John & Nisha Whitehead via The Rutherford Institute, Step away from the blinders that partisan politics uses to distract, divide and ...

Prepping For War? Chinese Spy Balloon Belies Much Larger Economic Warning Signs Submitted by QTR’s Fringe Finance By now you probably know the Chinese spy balloon that, for some reason, was allowed to traverse the ...

Cartels are groups of organizations that collude with each other to drive up prices, crush competition, and ultimately extort huge amounts of money to redistribute to the cartel members. While the word is often associated ...

Elon Musk is going head to head with his old company PayPal as Twitter gears up to become an online payments business. Twitter is prepping for payments, and bitcoin might be in the mix. According ...

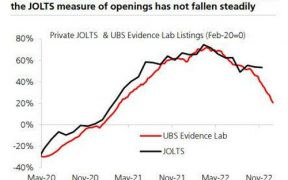

Just Make it Up: Job Openings Unexpectedly Soar As Labor Department Now Guessing What The Number Is What a coincidence: just yesterday we presented the latest report from UBS economists showing that the job openings ...

‘Curiouser And Curiouser’ – Is Joe Biden Serving Two Masters? Authored by Rob Smith via RealClear Wire, Here is something you won’t hear anywhere else. It is clear that Joe Biden is being ratted out ...