China’s Two-Decade Global Steel Expansion “Has Now Ended”

Share

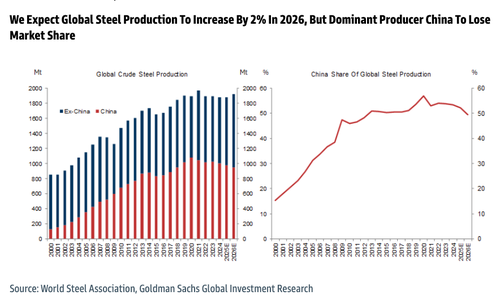

In Goldman’s latest global steel outlook, analysts Aurelia Waltham, Eoin Dinsmore, and others highlight a key inflection point: China’s share of global steel production has declined for the first time in over two decades, reversing a multi-decade expansion period.

“After more than two decades of China increasing its share of global steel production, we believe this structural trend has now come to an end as China’s domestic demand continues to falter and barriers to steel exports intensify,” Waltham and her team wrote in a note published on Friday morning.

The analysts noted that their global steel supply and demand model forecasted a 3% and 4% year-over-year increase in ex-China steel demand for 2025 and 2026, respectively. As Chinese steel exports are expected to decline, ex-China crude steel production is projected to rise by 3% in 2025 and 8% in 2026.

“While we are bearish on US and European steel prices on the three-to-six month horizon, we expect a re-acceleration in demand growth and lower Chinese steel exports to provide price upside in 2026,” Waltham said.

They outlined the biggest risk to their forecast of China losing global market share:

We see the biggest risk to our call that China will start to lose market share of global steel production to the rest of the world over the next two years being indirect[1] Chinese steel exports continuing to climb, pushing down rest of world apparent steel demand. This would likely see China steel demand from the manufacturing sector exceeding our current expectations, preventing a decline in Chinese steel output and apparent domestic demand, while at the same time meaning rest of world steel production growth would fall below end use consumption growth. However, this would be at odds with China’s policy to reduce steel output.