Hedge Fund Positioning Ahead Of CPI Is At 5-Year Lows

Share

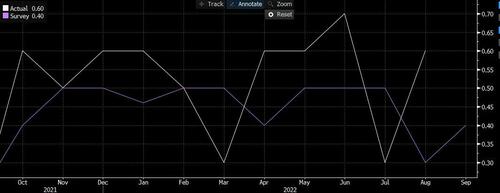

It’s understandable that traders, both retail and hedge funds, will be nervous ahead of tomorrow’s CPI print: as we noted earlier, with just one exception – the CPI report for July – the S&P 500’s response has been to slide every time the data was released as inflation has chronically come in hotter than expected. In fact, as shown in the chart below, core CPI has come in at or above expectations on 9 of the past 11 occasions.

But this nervous?

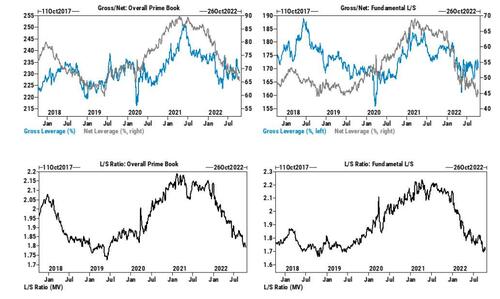

According to Goldman’s Prime Brokerage, ahead of the CPI print, as US stocks tested YTD lows yesterday, the pace of net selling from hedge funds accelerated with the overall Prime book seeing the largest notional net selling since mid-September (-1.7 SDs 1-year), driven by short sales outpacing long buys ~5 to 1.

Furthermore, as stocks across all regions were net sold led in notional terms by North America, Europe, and EM Asia, US equities were net sold for a 5th straight day and saw the largest notional net selling in nearly a month (-1.0 SDs), driven by short sales outpacing long buys nearly 4 to 1.

Both Single Stocks and Macro Products (ETF and Index combined) were both net sold and made up 62% and 38% of the notional net selling, respectively. 8 of 11 sectors were net sold, led in notional terms by Info Tech, Industrials, Energy, and Financials, while Consumer Disc, Staples, and Health Care were the only net bought sectors. Info Tech stocks were net sold for a 4th straight day and saw the largest notional net selling in nearly 6 months (-1.8 SDs), driven by short sales and to

Continue reading Hedge Fund Positioning Ahead Of CPI Is At 5-Year Lows at ZeroHedge.