Wall Street Agrees: A Red Wave In The Midterms Will Push Stocks Higher

Share

Well, technically, any outcome tomorrow will be beneficial for stocks, but a red wave should be especially bullish.

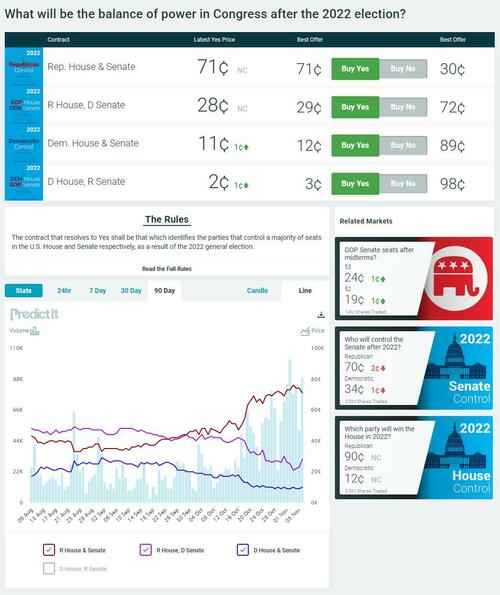

According to Deutsche Bank economists, their base case is that Republicans will take the House but Democrats will maintain their slim majority in the Senate, although they admit that the latter is a close call. And indeed, according to PredictIt, the odds of a Red tide (full sweep) have now risen to 71%, more than double from their early September lows.

That said, it is highly unlikely that either party will achieve a two-thirds majority in Congress, thus effectively maintaining President Biden’s veto power and continuation of the mostly lame duck Congress courtesy of Joe Manchin (with a few notable exceptions).

While DB tries its best to remain impartial, Morgan Stanley has no such qualms, and in his latest Weekly Warmup note (available to professional subs in the usual place), chief US equity strategist Michael Wilson – who is becoming less bearish by the day – writes that investors should remain bullish on equities ahead of this week’s US midterm elections, because polls pointing to Republicans winning at least one chamber of Congress provide a potential catalyst for lower bond yields and higher equity prices, which would be enough to keep the bear-market rally going.

According to Wilson, a “clean sweep” by the Republicans could greatly increase the chance of fiscal spending being frozen and historically high budget deficits being reduced, fueling a rally in 10-year Treasuries that can keep the equity market rising. And, echoing what we said all the way back in January, the only possible stimulus for the next two years